The Official Monetary and Financial Institutions Forum’s (OMFIF) Gender Balance Index 2023, in collaboration with EDGE Certification, shows that the progress of the world’s leading financial institutions in achieving gender balance is slow.

We have selected three revealing graphs from the Gender Balance Index that pinpoint the areas where central banks, commercial banks, public pension funds, and sovereign funds are falling short in their pursuit of gender equality, offering valuable insights into areas that require urgent attention and improvement.

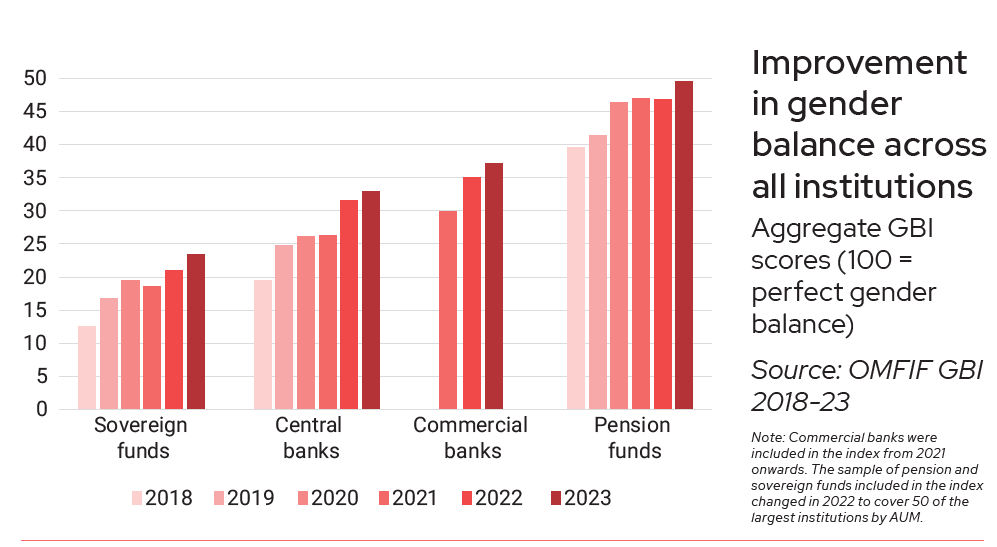

Gender parity within financial institutions is moving in the right direction, but not fast enough.

While gender balance looks to be improving in central banks, commercial banks, pension funds and sovereign funds, it’s crucial that these institutions become more ambitious and intentional when it comes to establishing gender balance targets.

- Across the 336 institutions covered in the GBI, only 14% are led by women.

- Women make up 24% of deputy governors and C-suite staff and 30% of senior staff across all institutions in the index.

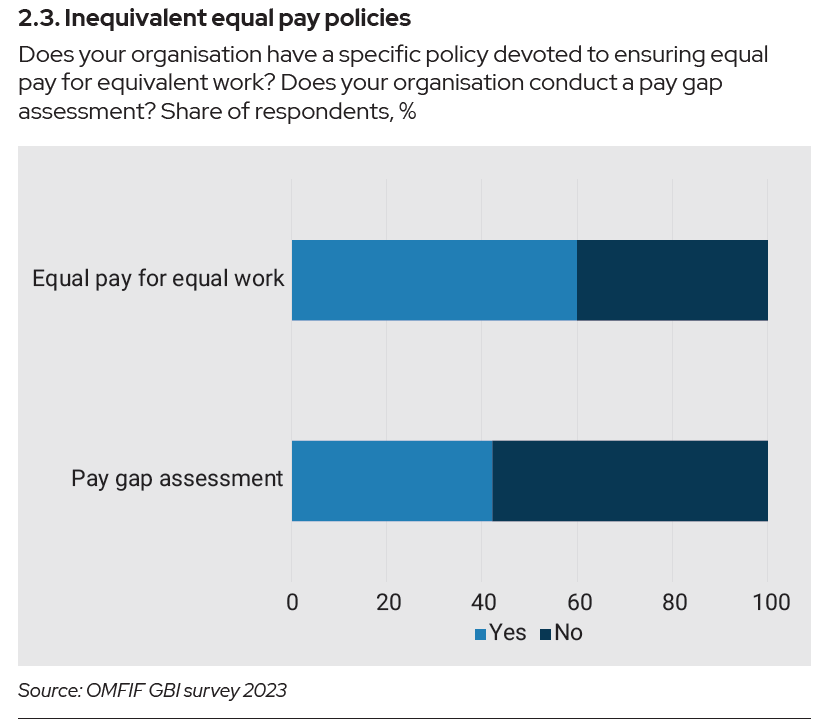

There is a need for more central banks to adopt equal pay policies

Generally, central banks across the world are improving their gender balance. However, it also revealed that central banks whose gender balance has declined over the past five years are far less likely to have dedicated resources for equal pay policies.

- Currently, 60% of central banks surveyed have a specific policy regarding equal pay for equal work, while only 42% implement a pay gap assessment.

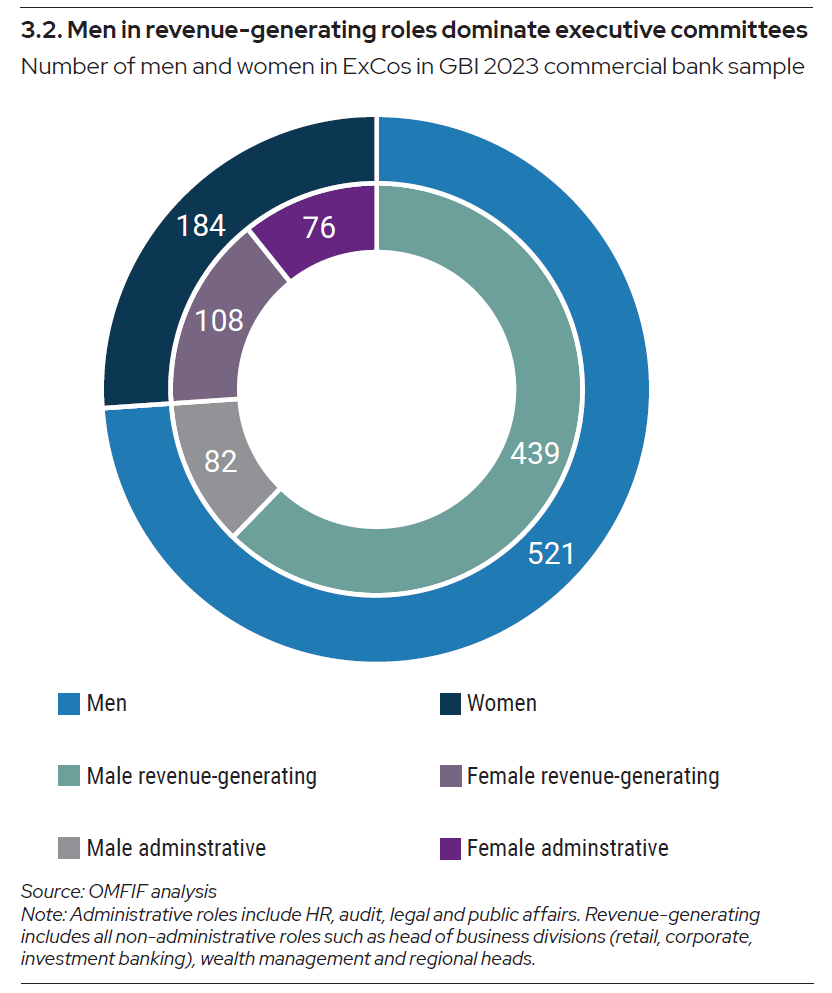

The current pipeline of future leaders is heavily skewed towards men

The current pipeline of future leaders is heavily skewed towards men, with female representation in the top ranks unlikely to significantly change in the coming years.

- Executives who oversee major business divisions with profit and loss responsibility are more likely to become future leaders of banks, rather than those who hold internal functions such as human resources or marketing.

- Women are much less likely to hold revenue-generating roles in ExCos than their male counterparts.

- Just 108 of the 184 women in ExCo positions are in profit and loss-related roles, equivalent to 59%, this share is 84% for men (439 of 521 men in executive roles).

EDGE Certification

EDGE Certification is a globally recognized standard for workplace diversity, equity, and inclusion. Our rigorous and credible methodology, which includes independent verification by a third-party auditor, ensures that our certification is a trusted indicator of an organization’s commitment to DE&I. EDGE Certification not only makes an organization’s DE&I progress visible to the outside world, but can also help it to gain recognition and visibility through high rankings in esteemed indexes like the OMFIF GBI.